Global Semiconductors Giants Quarterly Sales Comparisons with TSMC, Intel, ASML etc

Table of Contents

Global Semiconductors Giants Quarterly Sales Comparisons

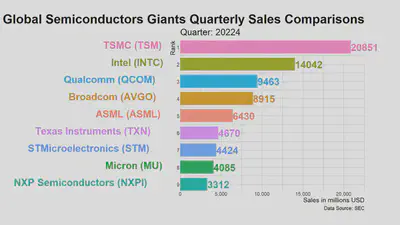

In this video, we compare the quarterly sales for the major players in the semiconductors industry. Those big companies, ordered from the largest quarterly sales in the fourth quarter of 2022 to the smallest, are Taiwan Semiconductor Manufacturing Company, Intel, Qualcomm, Broadcom, ASML, Texas Instrument, STMicroelectronics, Micron, and XNP Semiconductor. The data is from the first quarter of 2000 to the fourth quarter of 2022. Sales amounts are all in million USD.

The key insight in this video is that since the second quarter of 2022, TSMC beats Intel in terms of quarterly sales. TSMC has the advantage of more advanced chip making technology and higher yield rates.

Welcome to Sunfortzone, our goal is to help value investors understand more about their investments. If you want to grow on the path of value investing, please subscribe to our channel and click the like button on the video. Wall streets make money on activities, we, as value investors, make money on inactivities.

Here we would like to recommend a great book called The Intelligent Investor by Benjamin Graham. The book is suggested by value investor Warren Buffet. As Warren Buffet said, Chapters 8 and 20 in this book have been the bedrock of my investing activities for more than 60 years. I suggest that all investors read those chapters and reread them every time the market has been especially strong or weak. The link of the ebook is in the description below, you can read it a little bit for free in the Kindle.

Quarterly sales refer to the revenue generated by a company over a period of three months, typically one quarter of a fiscal year. In financial statement analysis, quarterly sales are an important metric that investors and analysts use to evaluate a company’s performance and growth potential. Sales is also an important metric to evaluate how much value a company can deliver to the mmarketplace.

Samsung, a Korean semiconductor company, is one of the big players in the chip making industry. However, as of now, we’re unable to find reliable quarterly sales data of Korean companies. We’re eager to parse Korean fundamental data in the future.

Brief Introduction of the Global Semiconductors Industry

The global semiconductor industry refers to the design, development, production, and sale of semiconductor devices, which are used in a wide range of electronic products such as computers, smartphones, automotive electronics, and many others. The industry is highly competitive and dynamic, with constant innovation and technological advancements driving growth and change.

The semiconductor industry has experienced significant growth over the past few decades, with increasing demand for electronic products worldwide. The industry is dominated by a few large players, with companies such as Intel, Samsung, and TSMC holding significant market share.

The industry is characterized by rapid changes in technology and high R&D expenses, with companies investing heavily in research to develop new and innovative semiconductor products. The industry is also highly cyclical, with demand influenced by factors such as global economic conditions, consumer spending, and technological innovation.

The semiconductor industry has a significant impact on global economies, providing high-paying jobs and driving innovation in a wide range of industries. The industry has also faced challenges related to supply chain disruptions, trade tensions, and geopolitical risks, highlighting the importance of resilience and flexibility in the face of global uncertainties.

Introduction of Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Company Limited, also called TSMC, is a Taiwanese multinational semiconductor contract manufacturing and design company. It is the world’s most valuable semiconductor company, the world’s largest dedicated independent pure-play semiconductor foundry, and one of Taiwan’s largest companies, with its headquarters and main operations located in the Hsinchu Science Park in Hsinchu. It is majority owned by foreign investors.

Founded in Taiwan in 1987 by Morris Chang, TSMC was the world’s first dedicated semiconductor foundry and has long been the leading company in its field. When Chang retired in 2018, after 31 years of TSMC leadership, Mark Liu became chairman and C. C. Wei became Chief Executive. It has been listed on the Taiwan Stock Exchange since 1993. In 1997 it became the first Taiwanese company to be listed on the New York Stock Exchange as symbol TSM. Since 1994, TSMC has had a compound annual growth rate of 17.4% in revenue and a compound annual growth rate of 16.1% in earnings.

Most of the leading fabless semiconductor companies such as AMD, Apple, ARM, Broadcom, Marvell, MediaTek, Qualcomm and Nvidia, are customers of TSMC, as are emerging companies such as Allwinner Technology, HiSilicon, Spectra7, and UNISOC. Leading programmable logic device companies Xilinx and previously Altera also make use of TSMC’s foundry services. Some integrated device manufacturers that have their own fabrication facilities, such as Intel, NXP, STMicroelectronics and Texas Instruments, outsource some of their production to TSMC. At least one semiconductor company, LSI, re-sells TSMC wafers through its ASIC design services and design IP portfolio.

TSMC has a global capacity of about thirteen million 300 mm-equivalent wafers per year as of 2020 and makes chips for customers with process nodes from 2 microns to 5 nanometres. TSMC was the first foundry to market 7-nanometre and 5-nanometre production capabilities, used by the 2020 Apple A14 and M1 SoCs and the MediaTek Dimensity 8100, and the first to commercialize extreme ultraviolet lithography technology in high volume, also called EUV.

Thanks for spending your valuable time with us! If you like our content, please like and subscribe to our channel to get more valuable content. Furthermore, please visit our website for more data-driven insights, and join our Discord server to discuss with other investors.