Why are EV makers Rivian and Lucid still losing money?

Table of Contents

Why are EV makers Rivian and Lucid still losing money?

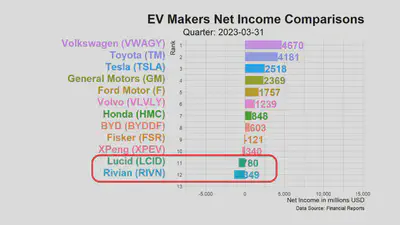

If we look at the financial reports of Rivian and Lucid in the first quarter of 2023, Lucid has a net loss of 780 millions. Rivian is even worse, encountering a net loss of 1.349 billions, while Tesla having a net income of 2.5 billions.

Introduction to Electric Car Manufacturers Rivian and Lucid

Rivian and Lucid are both prominent players in the electric vehicle industry, each with unique positions and contributions. Here’s a brief introduction to both companies:

Rivian

Rivian is an American automaker specializing in the production of electric vehicles. They are known for their innovative approach to design and technology, particularly in the electric pickup truck and SUV segments. Rivian has gained significant attention and investment from major companies like Amazon and Ford. One of their standout products is the Rivian R1T, an all-electric pickup truck, which offers impressive off-road capabilities and a long electric range. Rivian’s focus on adventure-oriented electric vehicles and their commitment to sustainability make them a notable player in the EV industry.

Lucid

Lucid Motors is a luxury electric vehicle manufacturer that aims to redefine the concept of sustainable transportation. The company’s primary focus is on producing high-performance electric luxury cars with cutting-edge technology and exceptional range. Their flagship model, the Lucid Air, boasts advanced features like a spacious and luxurious interior, industry-leading battery efficiency, and impressive acceleration capabilities. Lucid aims to compete directly with other luxury automakers, emphasizing not only sustainability but also luxury and performance. They have positioned themselves as a company that combines advanced EV technology with the comfort and refinement expected from high-end luxury vehicles.

Both Rivian and Lucid bring unique perspectives and offerings to the EV industry. Rivian stands out with its adventure-focused electric pickup trucks and SUVs, catering to those seeking off-road capabilities and ruggedness. On the other hand, Lucid focuses on delivering high-performance luxury electric cars, challenging traditional luxury automakers by offering advanced technology and sustainability in a luxury package.

Welcome to Sunfortzone, our goal is to help value investors understand more about their investments. If you want to grow on the path of value investing, please subscribe to our channel and click the like button on the video. Wall streets make money on activities, we, as value investors, make money on inactivities.

Hey there, fellow value investors! Are you always on the lookout for new insights and knowledge to enhance your investment strategies? Well, do I have something exciting to share with you today!

Introducing Kindle Unlimited, a game-changer for avid readers and learners like us. With Kindle Unlimited, you can enjoy unlimited access to over 1 million books, including bestsellers, timeless classics, and even books with Audible narration!

And the best part? I’ve got an exclusive offer for you! By signing up for a pre-paid plan, you can save big and dive into a world of unlimited reading pleasure.

Here’s how it works: Get 5% off a 6-month pre-paid plan, 10% off a 12-month pre-paid plan, or a whopping 20% off a 24-month pre-paid plan! That’s incredible value right there!

Imagine having access to a library of knowledge at your fingertips, covering a wide range of topics, from finance and investing to personal development and beyond. Kindle Unlimited has it all.

And don’t worry, after the pre-paid period, Kindle Unlimited renews at just $9.99 per month, plus applicable taxes. You have the flexibility to cancel anytime if it’s not for you.

Now, here’s the catch: This offer is only valid for new Kindle Unlimited customers. So, if you haven’t tried it before, now is the perfect time to join the club!"

By using the link, you not only unlock a world of knowledge but also help support this channel. For every redemption driven by you, I earn a bounty.

So, what are you waiting for? Click the link, sign up for Kindle Unlimited, and let’s embark on an endless journey of learning, discovery, and value investing wisdom together!

Reasons why Rivian and Lucid are still incurring losses

Rivian and Lucid, like many electric vehicle makers, are having losses for the following several reasons.

Reason 1 High Initial Investment

Developing and manufacturing electric vehicles requires significant upfront investment in research and development, manufacturing facilities, supply chain setup, and infrastructure. These expenses can contribute to initial losses as companies ramp up production and scale their operations.

Reason 2 Production and Scaling Challenges

Building a robust manufacturing process and supply chain for EVs can be complex and costly. Achieving economies of scale and efficient production can take time, especially for companies that are still in the early stages of production. During this period, higher costs per unit and lower production volumes can lead to losses.

With Lucid producing around 10 thousand vehicles per year and Rivian producing 24 thousand vehicles per year, it’s hard for them to have economies of scale. On the other hand, Tesla is able to produce around 1.36 millions cars per year. That’s a huge difference.

Elon Musk, the CEO of Tesla, mentioned the term “production hell” during Tesla’s shareholder meeting in 2017. This refers to the significant production pressure and challenges that Tesla faced when producing new vehicle models.

The term “production hell” signifies the difficulties an automotive manufacturing company may encounter when launching new models or expanding production capacity. These difficulties can include issues related to production line construction, supply chain management, and manufacturing processes, resulting in an inability to meet market demand. Musk used this term to describe the production challenges Tesla faced when launching new vehicle models, such as the Model 3.

At the time, the introduction of the Model 3 by Tesla was a significant event as it aimed to be an affordable electric vehicle model, designed to expand Tesla’s market share and enable mass production. However, the scale and speed of producing the Model 3 exceeded Tesla’s previous experience and capabilities, leading to production issues and delays.

Therefore, when Musk used the term “production hell,” he implied that Tesla was actively addressing these production challenges and striving to achieve the intended production targets. He emphasized the importance of balancing high production capacity with high-quality production, while highlighting the efforts and struggles invested in achieving Tesla’s goals.

Reason 3 Limited Market Penetration

While the demand for EVs has been increasing, the market for electric vehicles is still relatively small compared to traditional internal combustion engine vehicles. Limited market penetration, especially in the early stages, can result in lower sales volumes, impacting the overall profitability of EV manufacturers.

Reason 4 Increasing Competition

The electric vehicle industry is experiencing a surge in competition as numerous car makers are entering the market and introducing new models. This increasing competition is driven by several factors:

Established Automakers Joining the Race: Traditional automakers are recognizing the potential of electric vehicles and are investing heavily in their development. Companies like Volkswagen, Toyota, General Motors, Ford, and BMW are expanding their electric vehicle offerings to compete with pioneering brands like Tesla.

New Entrants and Startups: Beyond established automakers, several new entrants and startups are emerging in the electric vehicle space. Companies like Rivian, Lucid Motors, NIO, and Xpeng are gaining traction with their innovative and technologically advanced electric vehicles, posing a challenge to established players.

Diverse Product Offerings: Car manufacturers are diversifying their electric vehicle product lines to cater to various customer segments. They are introducing electric SUVs, crossovers, sedans, and even electric pickup trucks to address different consumer preferences and market demands.

Overall, the increasing competition in the electric vehicle industry is resulting in a broader range of electric vehicle options for consumers, improved technology, and more affordable prices. This competition is spurring innovation, driving companies to differentiate themselves through features, performance, and charging infrastructure, ultimately benefiting consumers and accelerating the adoption of electric vehicles globally.

Reason 5 Pricing and Cost Challenges

Electric vehicles often have higher upfront costs compared to conventional vehicles due to the cost of battery technology. While battery costs have been decreasing, they still contribute significantly to the overall price of EVs. EV manufacturers may face challenges in pricing their vehicles competitively while maintaining profitability.

Reason 6 Infrastructure Development

The adoption of EVs is dependent on the availability of charging infrastructure. In some regions, the charging network may still be underdeveloped, which can impact consumer adoption rates and hinder the growth of EV manufacturers.

It’s worth noting that the EV industry is rapidly evolving, and companies like Rivian and Lucid may have long-term strategies in place to address these challenges. As the market expands, technological advancements continue, and economies of scale are achieved, these companies may aim to improve their financial performance and achieve profitability.

Thanks for spending your valuable time with us! If you like our content, please like and subscribe to our channel to get more valuable content. Furthermore, please visit our website for more data-driven insights, and join our Discord Server to discuss with other investors.

Why do you think Rivian and Lucid are still incurring losses? We would love to hear your thoughts on this topic. Please comment below. We appreciate your feedback.