Apple's Q4 2023 Earnings Call Summary | Gross profit margins hits a new high at 45.87%, with iPhone sales reaching historic highs in countries such as the Philippines and Mexico!

Table of Contents

Summary of Apple’s Q4 2023 Financial Report

-

Revenue: $119.58 billion, a year-over-year increase of 2.1%.

-

Gross profit margin: 45.9%, a year-over-year increase of 2.9%, and a quarterly increase of 0.7%, benefiting from optimized product mix, reaching a new high.

-

Operating margin: 33.8%, a year-over-year increase of 3.1%, and a quarterly increase of 3.7%.

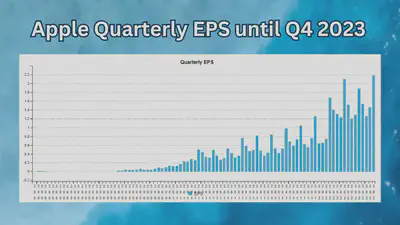

- Q4 2023 EPS was $2.18, a year-over-year increase of 15.8%.

Apple’s Q4 2023 Sales Breakdown

iPhone

iPhone has a revenue of $69.7 billion, a year-over-year increase of 6%.

- Multiple emerging markets set sales records, with total revenue reaching an all-time second high, with China being the only region experiencing a 13% year-over-year decline.

Cook stated that in the fourth quarter, “emerging markets have been a very key growth area for Apple,” and mentioned that “many emerging markets have achieved strong double-digit growth, with historic highs in Malaysia, Mexico, the Philippines, Poland, and Turkey, while achieving fourth-quarter highs in India, Indonesia, Saudi Arabia, and Chile.”

• 2.2 billion active smartphones, up 10% from the same period last year when it was 2 billion.

Wearable Devices

Wearable Devices has a revenue of $11.95 billion, down 11.3% year-over-year.

Revenue from Wearables, Home, and Accessories totaled $12 billion, a decrease of 11% compared to the same period last year, due to challenging product launches compared to the prior year period which had an additional week. Last year at this time, we benefited throughout the quarter from the releases of the second-generation AirPods Pro, Watch SE, and the first Watch Ultra. We continue to attract new customers to Apple Watch, with nearly 2/3 of customers purchasing Apple Watch being new to the product. According to the latest report from 451 researches, customer satisfaction in the United States is at 96%.

Mac

Mac has a revenue of $77.8 billion, up 0.6% year-over-year.

• Saw a significant rebound from a 33.8% year-over-year decline in Q3 2023, still down about 25% compared to the pandemic period.

iPad

iPad has revenue of $70.2 billion, down 25.3% year-over-year.

• Significant year-over-year decline in iPad revenue due to the prolonged absence of new product releases.

Services

Services has a revenue of $231.2 billion, up 14% year-over-year.

• Achieved a historic high in revenue, primarily driven by increases in advertising, cloud services, Apple Pay, and the App Store.

• Double-digit growth in subscription numbers.

In terms of services, Apple is highly satisfied with its double-digit growth, which is attributable to the strength of our ecosystem. Our installed base now exceeds 2.2 billion active devices and continues to grow steadily, providing a solid foundation for the future expansion of our services business.

We also continue to see increased customer engagement with our services. Both transaction accounts and paid accounts have reached historic highs, with double-digit year-over-year growth rates for paid accounts.

Additionally, our paid subscriptions demonstrate strong double-digit growth. We now have over 1 billion paid subscriptions across our platforms, more than double the number from just four years ago.

Welcome to Sunfortzone, our goal is to help value investors understand more about their investments and become a better person.

If you want to grow on the path of value investing, please subscribe to our Youtube channel to get more valuable contents in the future.

Wall streets make money on activities, we, as value investors, make money on inactivities.

Here, we introduce a high-quality US stock brokerage called Interactive Brokers, which we primarily use as a channel for investing in US stocks.

Interactive Brokers has three main advantages. First, it was established in 1978 and is the world’s largest online brokerage. Its ticker symbol on the US Nasdaq stock exchange is IBKR. It is listed on the Nasdaq with a market capitalization of approximately $8.7 billion USD. If you check its profitability on our website, go to the Stock Analysis page at Sunfortzone.com, search for IBKR, you can see that Interactive Brokers’ quarterly net profits are positive and in a growing trend, indicating very low risk of bankruptcy.

Second, Interactive Brokers allows investment in a wider variety of assets. As a global brokerage, Interactive Brokers enables the purchase of stocks worldwide, including countries such as the United States, China, Japan, Germany, France, Canada, Australia, Italy, and more. Regarding ETFs, Interactive Brokers offers a diverse selection, such as TQQQ, a triple-leveraged Nasdaq ETF.

Third, Interactive Brokers allows fractional share purchases, meaning you can buy units smaller than one whole share. This is suitable for high-priced stocks like Berkshire Hathaway, which trades at around $490,000 per share. With Interactive Brokers, you can invest a specific amount of money without having to buy a whole share. For example, you can set to buy $100 worth of Berkshire Hathaway shares. The drawback of fractional shares is that they do not come with voting rights, but you can still receive dividends from fractional shares.

Here at Sunfortzone, we provide an exclusive account opening offer link for Interactive Brokers. For every $100 deposited, you can receive $1 worth of IBKR stock, with a maximum value of $1,000 IBKR stock!

We strongly recommend our friends who are serious about their investments to open an account, deposit over $10,000 USD within 30 days, and invest in good, undervalued stocks at the right time, holding them for at least a year.

As Warren Buffett said, one crucial aspect of investing is to start early. Buffett bought his first stock at around the age of ten and continuously accumulated wealth like a rolling snowball, leading to his current achievements, emphasizing the importance of continuous learning and growth.

Key Points from Apple’s Earnings Call

AI Applications

• The company stated that it will introduce exciting AI applications this year, with rumors suggesting it could involve adding more AI features to the voice assistant Siri, possibly alongside the launch of iPhone 16.

Regarding the voice assistant Siri, personally, I usually keep Siri turned off on my iPhone as having it constantly active drains the phone’s battery, causing it to heat up. If I need to ask a question, I find it more reliable to type and ask ChatGPT or Bard directly. Previously, I haven’t had good experiences with verbal queries to Siri.

Vision Pro

• The company announced in a press release that it will be adding over 600 Vision OS Apps, focusing on productivity and entertainment, to create a more comprehensive ecosystem, which is expected to further boost Vision Pro sales.

iPhone Outlook

• Sales in emerging markets set records, with sales in China declining by 13% year-over-year. The Americas region, which contributed the most to revenue, saw a 2.3% year-over-year increase in sales, albeit at a slower pace, but with improvements in average selling prices (ASPs) across all regions.

EU Antitrust Regulation

• The company has made changes to the App Store agreement in the European region, including reducing commissions from 15%-30% to 10%-17%; charging a fee of €0.50 for free apps that have over one million downloads; and allowing the download and installation of apps from third-party stores.

For apps that exceed one million installations annually, a core technology fee of €0.50 will be charged. A core technology fee will be charged for the first installation by the same customer account within 12 months. There will be no additional charge for repeat installations within the same year. Apple estimates that less than 1% of developers will pay the core technology fee, as most apps do not reach the threshold of one million annual installations.

The new fee structure reflects the fact that the Apple App Store will no longer be the only destination for apps for European customers. Developers can choose to accept Apple’s 10% to 17% commission to enter the App Store or distribute their apps elsewhere. However, core technology fees apply if apps exceed the quantity threshold, whether they are sold in the App Store or distributed through third-party markets.

• The EU region accounts for approximately 6% of the App Store, with limited impact, but there are concerns that other regions may follow suit, impacting revenue.

Gross Profit Margin Reaches 45.87%

• The gross profit margin is 45.87%, reaching a historic high, mainly driven by increases in product margins and service revenue, indicative of a long-term trend.

The company’s gross margin is 45.9%, up 70 basis points quarter-over-quarter, primarily driven by leverage and favorable mix, partially offset by foreign exchange.

Product gross margin is 39.4%, up 280 basis points quarter-over-quarter, similarly driven by leverage and mix, partially offset by foreign exchange.

The service gross margin is 72.8%, up 190 basis points quarter-over-quarter, primarily due to a more favorable mix.

Operating expenses were $14.5 billion, in the mid-point of the range provided in our guidance, up 1% year-over-year.

Net income was $33.9 billion, an increase of $3.9 billion from the previous year.

Diluted earnings per share were $2.18, up 16% from the previous year, reaching a historic high. Operating cash flow was very strong, reaching $39.9 billion.

Thanks for spending your valuable time with us! If you like our content, please like and subscribe to our Youtube channel to get more valuable content. Furthermore, please visit our website sunfortzone.com for more data-driven insights, and join our Discord Server to discuss with other investors.

If you’ve learned something from our productions, please check out the Interactive Brokers website and click the inclusive link down below to open an account for free. Your actions means a world to us!

What’s your idea? please leave a comment below! We would like to learn something from you as well!