Monthly Sales over time for Taiwan PCB companies Unimicron, Nanya and Kinsus from 2001 to 2023

Table of Contents

Monthly Sales over time for Taiwan PCB companies Unimicron, Nanya and Kinsus

Monthly Sales over time for Taiwan PCB companies

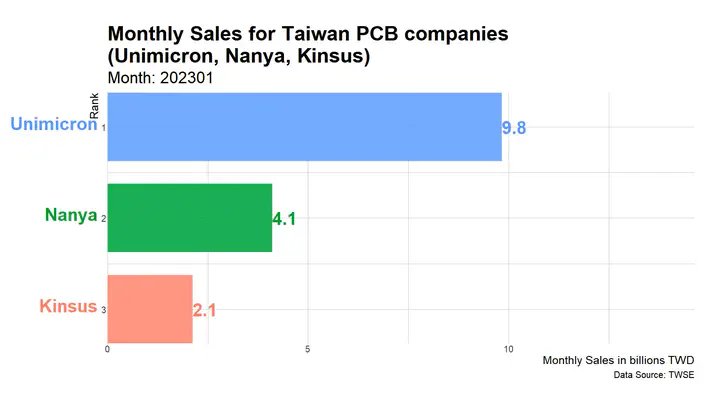

In the animation, we can see the monthly revenue over time for major PCB companies in Taiwan, namely, Unimicron, Nanya, and Kinsus. The data is from August 2001 to January 2023. From the perspective of monthly revenue, Unimicron and Nanya competed for the first place in the process, but in the end, Unimicron surpassed Nanya to become the PCB company with the largest monthly revenue. Unimicron is also an important ABF supplier for Apple, and it also exclusively supplies Apples’ headset device.

Welcome to Sunfortzone, our goal is to help value investors understand more about their investments. If you want to grow on the path of value investing, please subscribe to our channel and click the like button on the video. Wall streets make money on activities, we, as value investors, make money on inactivities.

Operational Overview for the PCB industry

Unimicron, Nanya and Kinsus are the three major players in Taiwan’s PCB (printed circuit board) industry. These three companies occupy an important position in Taiwan’s PCB industry. The green PCB is actually of low value, and the small thumb-sized carrier board inside the chip is of much higher value.

In 2021, benefiting from the vigorous development of global semiconductors, the PCB factories with the highest annual growth rate are all substrate manufacturers. There are 7 companies with revenues exceeding 1 billion US dollars, which are Taiwan Unimicron, Japan Ibiden, South Korea’s Samsung Electro-Mechanics, Shinko of Japan, LG Innotek of South Korea, Nanya and Kinsus of Taiwan.

In 2021, the output value of substrates will be 15.6 billion US dollars, accounting for 17.9% of the global circuit boards. Although there is a systematic shortage of chips in the world, driven by the demand for bigger ABF substrates and more layers, substrates is still in shortage this year. But from 2019 to 2025, global substrate manufacturers have invested more than US$ 25 billion in capacity expansion and building new factories, and they must pay attention to the price competition in the future. Generally speaking, the long-term upgrade trend of AI, HPC, and Cloud is still beneficial to the substrate industry.

Operational Overview for 3037 Unimicron

Zeng Zizhang, chairman of Unimicron, said that the profit growth in 2022 will be significant, and the dividend distribution next year will be much better than this year; since the second quarter, some customers have reduced their orders, and those who queue up can make up for it, but the impact is like waves coming one after another. There are still queues now, but the queue is shortened。

In the medium and long term, the demand for ABF substrates is still optimistic.

From 5G-related base stations, cloud, to 5G construction, AI, HPC, these technologies are more mature, it can help the positive development of applications such as self-driving cars, smart factories, artificial intelligence Internet of things, and so on.

Another point is that the trend of the supply chain transferring to Southeast Asia is clear. Geopolitics, trade wars, and other issues have caused many problems. The technological war is more likely to be a long-term war. In the long run, customers require suppliers to increase non-China or non-Taiwan production capacity. Substrates must increase overseas production bases as soon as possible. Unimicron, including other substrate peers in the industry, have also received demand from customers to transfer production capacity. However, Zeng Zizhang believes that it still depends on the grade of PCB. The higher the level of PCB, the water, electricity, human resources, and other aspects must be considered. It’s a continuous effort to evaluate how to disperse production capacity. However, Unimicron has already prepared factories overseas, which is relatively advantageous.

Operational Overview for 8046 Nanya

On the other side, Nanya’s revenue in the fourth quarter reached 17.7 billion Taiwanese dollars, an increase of 19% year-on-year. In terms of ABF substrates, the proportion of high-end substrates has increased compared with the third quarter of 2022, and the improvement of the product mix has driven the average sales price to increase by about 10% quarter-on-quarter. In terms of PCB product lines, demand was better than originally expected, with the main contribution coming from game console applications. Nanya’s product mix in the fourth quarter of 2022 is as follows: 60% of ABF substrates, 25% of BT substrates, and 15% of PCBs. Looking forward to the first quarter of 2023, although there are benefits from the new factories in the first phase of Shulin and the second phase of Kunshan, the average selling price is expected to encounter more obvious pressure from the first quarter of 2023 under the short-term price competition of mid- and low-end ABF substrates.

Thanks for spending your valuable time with us! If you like our content, please like and subscribe to our channel to get more valuable content. Furthermore, please visit our website sunfortzone.com for more data-driven insights, and join our Discord Server to discuss with other investors.

What’s your idea? please leave a comment below! We would like to learn something from you as well!